Are you looking to open a checking account or obtain a loan? Find a trusted, BBB Accredited bank or credit union near you at BBB.org.

Financial Institutions

Not since ATMs became a thing has there been so much excitement and interest in the banking industry. Many banks and credit unions look forward to increased revenue and profit in the post-pandemic world. This optimism stems from two key factors - a projected CAGR (Compound Annual Growth Rate) of 5.3% through 2026 (1) and interest rates on the rise to slow inflation (2).

Introduction

As the fintech and geobank startups continue to change the landscape of the banking industry, credit unions and traditional banks are now struggling to keep pace with similar products and innovative services. This white paper will discuss the emerging trends banks and credit unions should now embrace for customer retention and increased profitability as interest rates climb.

The digital transformation simply meant adding a mobile website or app and maybe a few third-party service options for many institutions. While back-office automation and new technology alone aren’t a complete solution, they are the tools the industry can use to improve the touchpoints at every step of the customer experience.

Consumers now expect to be able to pay or get paid virtually anywhere and at any time. The next logical step is to allow them to pay using every available option, which will require industry-wide changes to accommodate the ever-changing payment and currency options available.

As the industry tries to catch up with fintech providers, they’re finding the highly skilled talent they need in short supply. As a result, many smaller operations will have to retrain current staff to fill these roles or pay substantially higher wages to secure the skilled and talented workforce they require.

Financial institutions in 2022

The industry is poised for the most significant changes since the Dodd-Frank Act of 2010. But before we get to those changes and how much the banking industry will benefit, we’ll start with a brief industry overview.

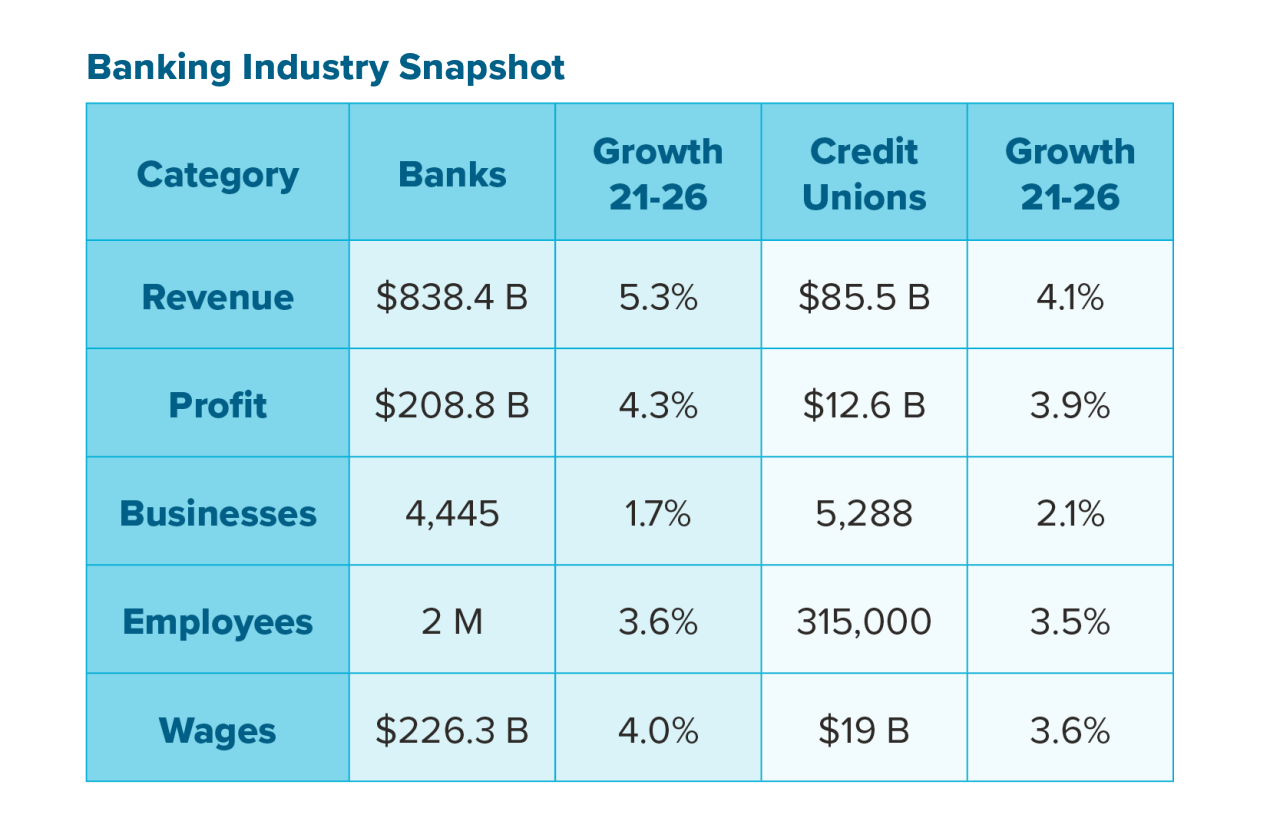

As the chart above shows, commercial banks generate nearly ten times more revenue than credit unions. Based on 2021 data, the profit margin is 24.7% for banks1 and 14.7% for credit unions.2

Another significant difference is the workforce generating the industry revenue. Banks utilize seven times as many employees as their credit union counterparts while paying out eleven more wages than credit unions.

The banking industry can expect to see higher demand for services moving forward from the pandemic. With employers offering higher wages to fill positions and retain key staff members, the disposable income rate increased by 3.6% in 2021 alone.

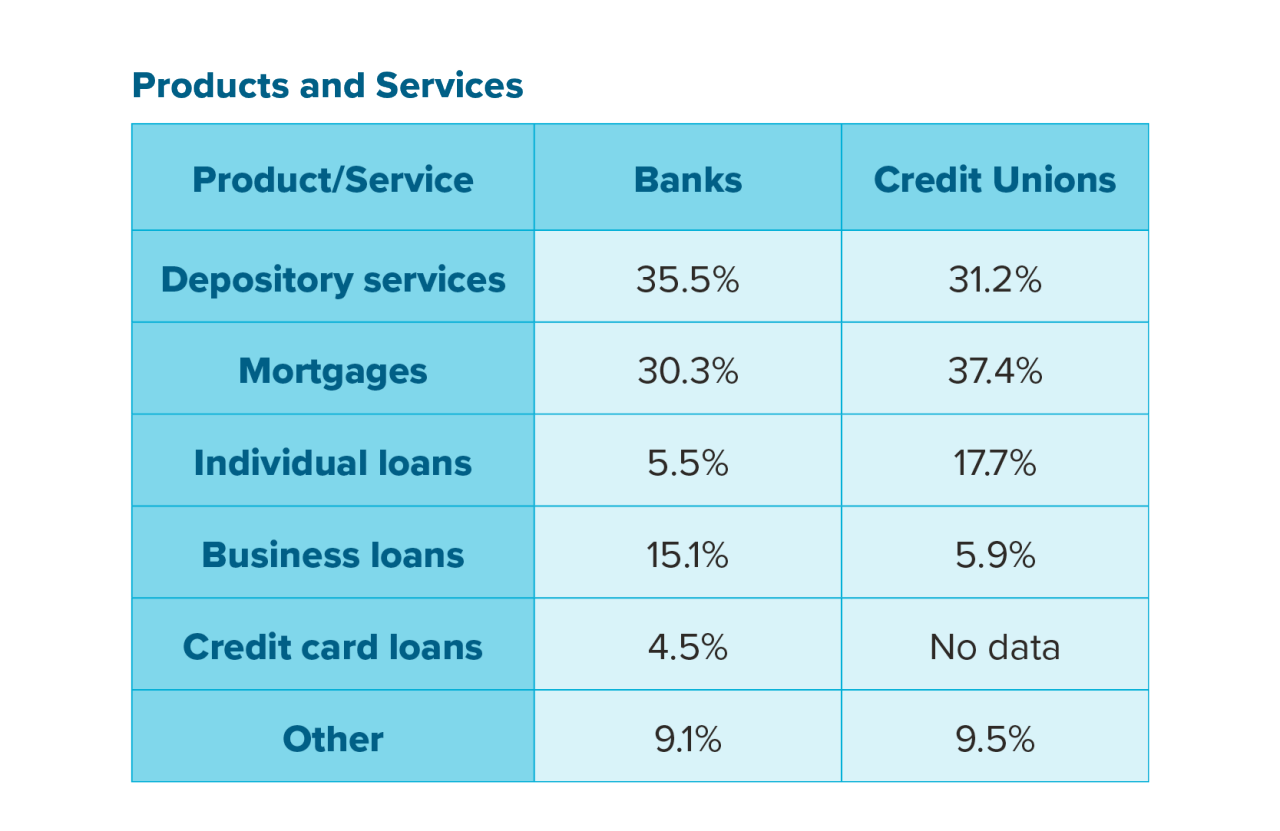

While banks and credit unions have different business structures and regulatory obligations, they provide very similar services, receiving customer deposits and issuing consumer, business, and industrial loans.

Commercial banks lead the business loan sector, while credit unions typically issue more individual loans. These include new and used vehicle loans. The leading services for both banking industry options are depository services, checking and savings accounts, and home mortgages.

The top four banks shared slightly more than 20% of the market and had combined revenue of $351.6 billion in 2021. On the other hand, the four leading credit unions had just 15.7% of the market share and revenue of $13.4 billion.

The industry remains restrained due to the historically low-interest rates over the last several years. However, industry profits increased in 2021 due to lower loan loss reserves held by operators. Banking industry revenues should continue to rise as mortgage rates increase, and the availability of new homes remains low.

One of the most pressing issues for those in the banking industry centers around the Dodd-Frank Act of 2010. Since becoming law, profits for the banking industry decreased due to higher compliance costs, fee reductions, and higher reserve requirements for all banks and credit unions.3 More changes may be on the horizon as legislators may soon tackle topics such as industry digitization, alternate currencies, and the myriad of payment platforms constantly changing the banking landscape.

Beyond 2022: emerging trends driving the industry

The lenders are poised to benefit from higher interest rates and increased demand for financial services. Unfortunately, many banks and credit unions are still catching up with their digital presence, limiting customer acquisition and retention rates. Today’s tech-savvy customer expects their bank or credit union to deliver customer-centric solutions using the latest technology and available data, including alternate payments and currencies. As online banking grows, the more robust and highly developed platforms will consistently out-perform older technology.

Lagging use of technology

According to a recent interview with Michael Abbott from Accenture, “We’ve become functionally correct and emotionally devoid. We’ve lost touch with our customers. We’ve lost the ability to have a conversation or ask a question of the customer. Today, technology can put the humanity back in banking by creating seamless operations and exceptional experiences.”4

Chatbots can help guide your customer to the appropriate website resource or connect them to a service representative. In addition, a push-to-talk/Zoom option can help ease those anxious moments after a customer has lost their debit/credit card or discovered a fraudulent charge on their statement.

Investment in cloud and AI technologies will allow banks and credit unions to leverage Application Programming Interfaces (APIs), develop improved customer solutions, and increase potential revenue sources. For example, Gartner5 predicts that by 2025, 20% of all test data will be synthetically generated, allowing improved fraud detection, trading prediction, and risk factor modeling for the banking industry.

Restructuring data to integrate with new third-party resources and platforms is critical for future growth. As Douglas Brown explained, “Use cases such as buy, sell, hold; cross-border remittance and payments will continue to become more common next year. Those that establish their strategies and expand member access to frictionless digital currency capabilities will be strongly positioned to compete with emerging threats, cement member loyalty, and create new revenue opportunities.”6

Changing payment and currency options

What was once a niche customer market has now gone mainstream, more than doubling revenue from $965 billion to $2.6 trillion in 2021. As a result, the banking industry should begin standardizing payment platforms to quickly adapt to changing alternative payments and currencies.

El Salvador was the first country to accept cryptocurrency as legal tender; Colorado will become the first state to accept cryptocurrency for state and fee payments starting in June 2022. Depending on the success of this endeavor, the Colorado example could become an example for other states to follow.

Another emerging alternate currency to consider is the NFT market. According to PRNewswire7, the NFT market expects a CAGR of 35.27%, which translates into $147.2 billion of additional revenue between 2021-26.

Over the last two years, the international movement for developing digital currency standards and regulations has continued to grow. One potential solution is establishing cryptocurrency standards via a Central Bank of Digital Currencies (CBDCs). Such measures would help simplify and lower international transfer costs and allow existing payment networks and platforms to work together seamlessly. But, of course, any CBCD option for the US dollar would also require a significant overhaul of the Dodd-Frank Act.

Finding talent in a highly competitive marketplace

Unfortunately, many legacy banks and credit unions that “digitized” focused much of their time and energy on managing expenses, securing systems, and regulation compliance. As a result, those slow to embrace complete digitization now suffer from a lack of highly skilled digital talent in the marketplace.

As Abbott put it, “Maybe the largest banks can, in theory, go out there and pay anything to anybody they want and get them, but that’s not going to be the case for the vast majority of financial institutions. For most organizations, training and reinvesting in existing people is needed…”4

One potential solution to the talent shortage is for financial institutions to implement industry-tested third-party providers to deploy new products and services to their customers. This strategy avoids the time, cost, and programming team needed to create a proprietary platform from the ground up.

While there’s no escaping the costs of retraining current staff or using a third-party platform, additional revenue from higher interest rates and service fees could be used to offset these additional costs over the short term.

Sources:

(1) IBISWorld US INDUSTRY (NAICS) REPORT 52213 / FINANCE AND INSURANCE Credit Unions in the US Report by: Kush Patel 2021

(2) IBISWorld US INDUSTRY (NAICS) REPORT 52211 / FINANCE AND INSURANCE Commercial Banking in the US Report by: Gabriel Schulman 2021

(3) www.doddfrankupdate.com/DFU/ArticlesDFU.aspx?issueid=e204b4e5-13b6-40e2-acda-cc44d6f04569

(4) www.accenture.com/us-en/insights/banking/top-10-trends-banking

(5) www.gartner.com/en/newsroom/press-releases/2022-05-24-gartner-identifies-three-technology-trends-gaining-tr

(6) www.cutimes.com/2022/01/19/4-trends-for-credit-unions-to-watch-in-2022/

(7) www.prnewswire.com/news-releases/non-fungible-token-nft-market-size-to-grow-by-usd-147-24----technavio-301529125.html